stock options tax calculator usa

How Does Stock Tax Calculator Work First of all you provide the. In our continuing example your theoretical gain is.

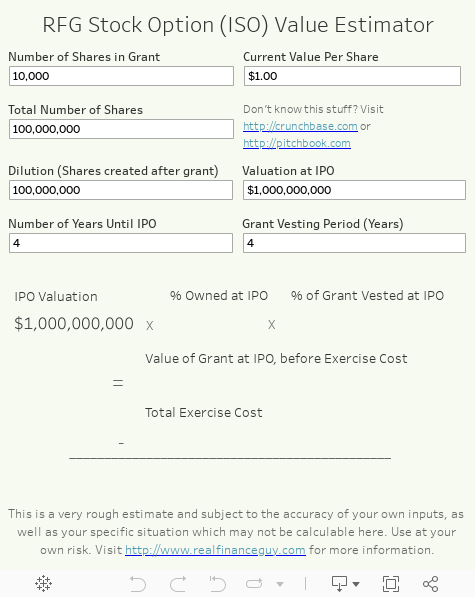

My Startup Stock Options Calculator Real Finance Guy

Non Qualified Stock Options Calculator Enter your information below Option Price Fair Market Value of Stock Estimated Federal Marginal Tax Rate Estimated State Marginal Tax Rate.

. Stock options tax calculator usa. Even taxpayers in the top income tax bracket pay long-term capital gains rates. Sullivan stock options take 50 billion bite out of corporate taxes tax notes.

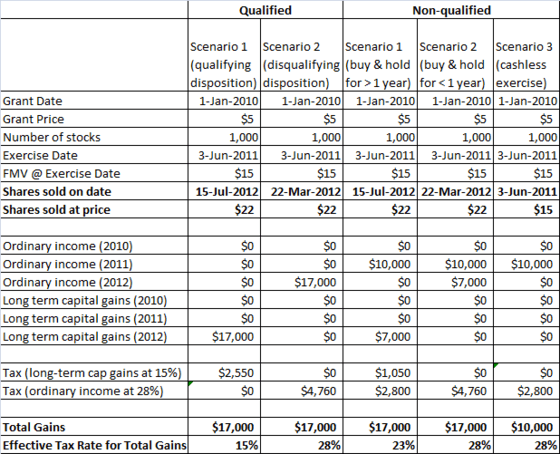

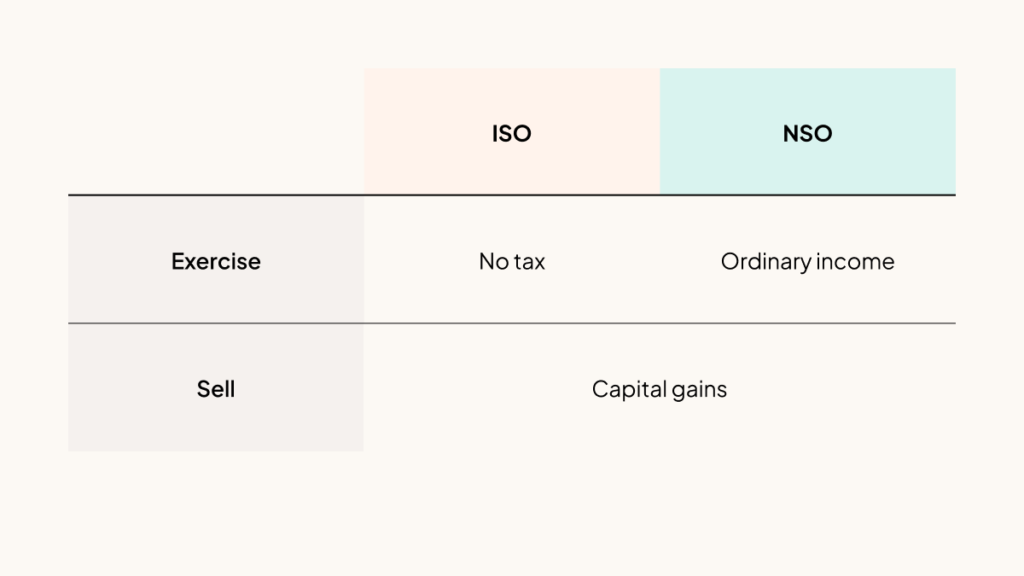

Ordinary income tax and capital gains tax. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. 60 of the gain or loss is taxed at the long-term capital tax rates 40 of the gain or loss is taxed at the short-term capital tax. Please enter your option information below to see your potential savings.

The same property or stock if sold within a year will be taxed at your. Additionally your marital status also influences your tax rate. On this page is a non-qualified stock option or NSO calculator.

Stock Options Tax Calculator Usa. Watch our explainer videos to dive into the platform. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Lets say you got a grant price of 20 per share but when you exercise your stock. 16000 - 15000 1000 taxable income. The post will cover how stock option taxation works at two.

Taxes for Non-Qualified Stock Options. This online calculator will calculate the exact amount of tax that you owe considering all the factors mentioned above. There are two types of taxes you need to keep in mind when exercising options.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. On this page is an Incentive Stock Options or ISO calculator. The Employee Stock Options Calculator.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. When cashing in your stock options how much tax is to be withheld and what is my actual. Section 1256 options are always taxed as follows.

Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. For use with Non-Qualified Stock Option Plans. Your payroll taxes on gains from exercising your NQ stock options will be 145 for Medicare only if and when your earned income exceeds the wage base for the given tax.

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Credit Karma Tax Vs Turbotax Which Is Better For Filing Taxes

Taxes On Stocks How Do They Work Forbes Advisor

What Is A Disqualifying Disposition With Incentive Stock Options What Can Cause It And Why Does My Company Care Mystockoptions Com

.png)

How To Calculate Iso Alternative Minimum Tax Amt 2021

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Options Esos A Complete Guide

Here Are 4 Big Tax Mistakes To Avoid After Stock Option Moves

Tax Basis And Stock Based Compensation Don T Get Taxed Twice

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Here Are 4 Big Tax Mistakes To Avoid After Stock Option Moves

You Can T Afford To Make Poor Decisions About Incentive Stock Options Techcrunch

2022 2023 Tax Brackets Rates For Each Income Level

How Are Stock Options Taxed Carta

Restricted Stock Units Jane Financial

Secfi Stock Option Tax Calculator

Free Income Tax Calculator Estimate Your Taxes Smartasset